- Invoice book for self employed how to#

- Invoice book for self employed plus#

- Invoice book for self employed professional#

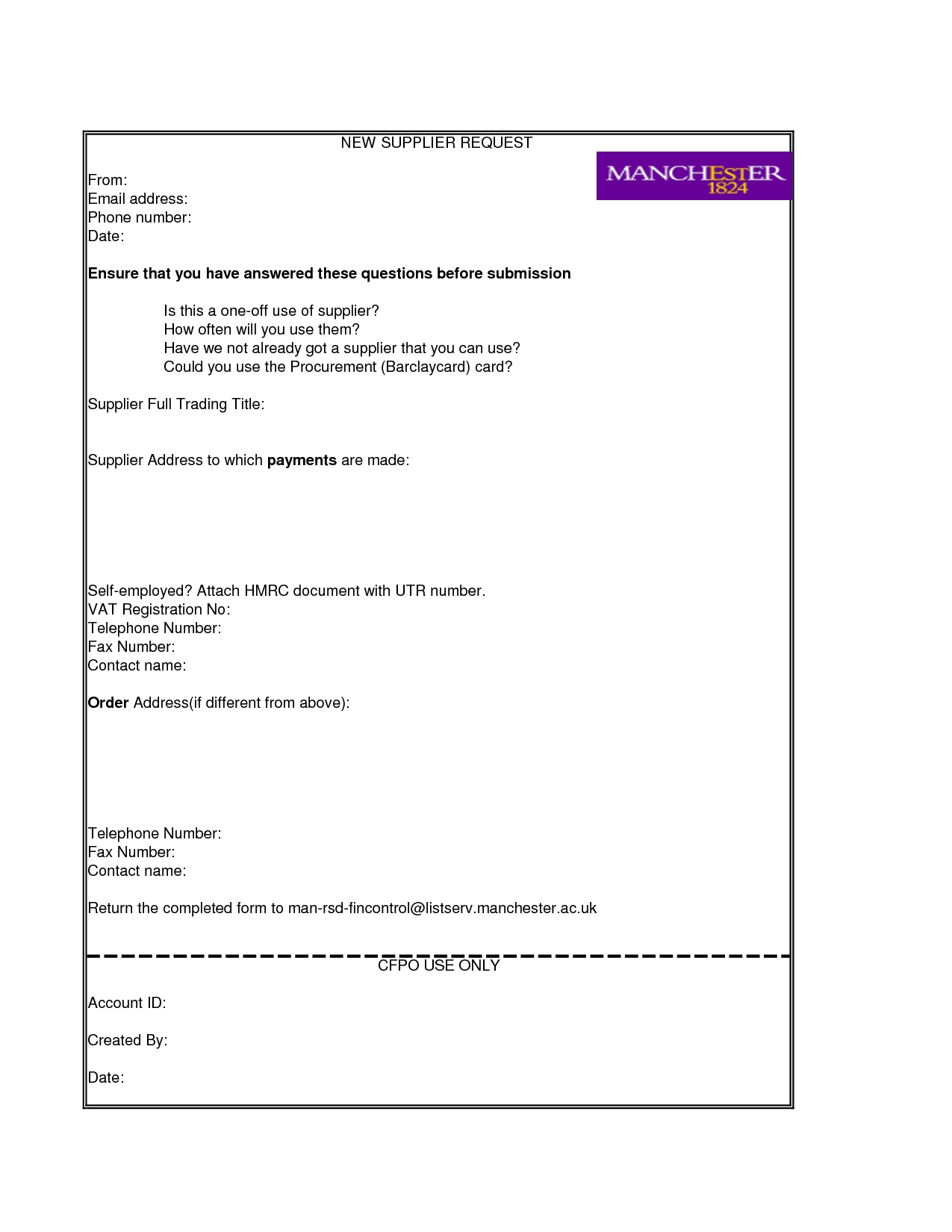

Include payment instructions for your client and the expected due date for your services. Be sure to include costs for each item or service on the invoice. Having a blank invoice template gives you the range to provide the most accurate information for your business. products, or work completed) being offered, as well as deliverables, so there is no confusion. It can be helpful to describe the services (i.e. You can customize the blank standard invoice template to suit the needs of you and your clients.

Invoice book for self employed plus#

Input unique invoice number on template, plus invoice date and due date.Include client’s name, business and contact details.Include your business name and contact information.

Invoice book for self employed how to#

Here’s how to invoice for self-employed professionals and freelancers: If you have preferred payment options, such as debit or credit cards, you should include this information as well.

Invoice book for self employed professional#

Keeping all of your client information accurate looks professional and legitimate. You will also include the services, cost, client name, client address, your business contact information, the terms of the invoice, date of issue and payment due date. Having a professional business invoice helps your company stand out from the crowd, and keeps things in order for you and your business services. To create a simple invoice for your self-employed or freelance business, you will want to download a professional invoice template and include a unique invoice number. Rather than hiring an accountant to create an invoice for you, using a personal invoice template helps you create a professional and detailed invoice for free. Pending payment status will no longer be a hassle. Keeping all of your billing information in order will work wonders for your tax invoice needs. This ensures that you are getting all of the information you need to avoid missed payments and headaches at tax time. A few reasons for using a self-employed invoice:Ī self-employed invoice lists your services, the cost, the payment details and more. Freelance invoice templates are a great way to keep track of your personal services and your business running smoothly and efficiently. Good news: Using a free personal invoice template is great for starters. What Is a Self-Employed Invoice Used for?Īs a business owner or freelancer, you may be wondering how to go about billing your clients and keeping them in check. Send invoices, track time, manage payments, and more…from anywhere. Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one placeįreshBooks integrates with over 100 partners to help you simplify your workflows Track project status and collaborate with clients and team members Tax time and business health reports keep you informed and tax-time ready Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours Wow clients with professional invoices that take seconds to create

0 kommentar(er)

0 kommentar(er)